Our industry goes through a lot of Mergers and Acquisitions (M&A). Information Handling Services (IHS) built its Technology, Media and Telecoms (TMT) in large part through the acquisition of Infonetics Research for an undisclosed sum in 2014. Then in 2016, IHS merged with London-based Markit to create IHS Markit. Then in 2019, IHS Markit swapped its TMT group with Informa's Agribusiness Intelligence group and $30 million in cash.

At the start of 2020, Omdia was formed by unifying the depth and breadth of expertise from Informa Tech’s legacy research brands: Ovum, IHS Markit Technology, Tractica and Heavy Reading.

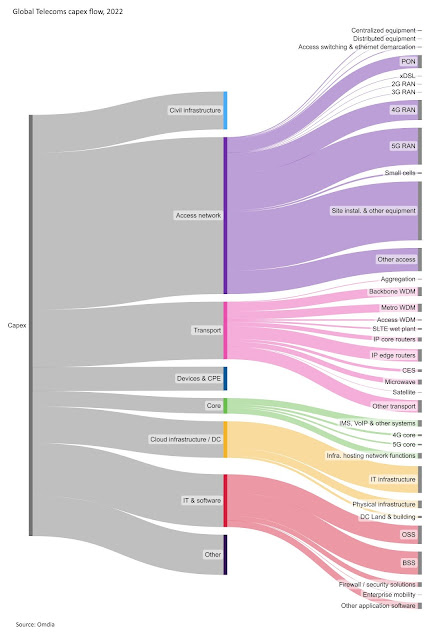

Omdia recently published the 2022 full-year update of its Global Telecoms Capex Tracker, a detailed database of telecom operator capital expenditure (capex) from 1Q19 to 4Q22. This Analyst Opinion covers the major recent developments in telecoms capex and highlights some interesting points from the tracker.

In the tracker, Omdia splits capex estimates into various categories and subcategories that broadly map to our technology market research coverage. For the full year of 2022, the first level of breakdown is into civil infrastructure (9%), access network (37%), transport (14%), core (4%), cloud infrastructure (9%), IT and software (13%), devices and customer premises equipment (CPE) (6%), and other (10%).

You can find the details here. The author, Adam Mackenzie, has shared a high-resolution picture and some more details on his LinkedIn post here. The comments are worth reading as well.

For people who are interested in similar topics, check out the links below 👇.

Related Posts:

- The 3G4G Blog: Understanding the TCO of a Mobile Network

- 3G4G: The Flow of Money in the Mobile Industry

- The 3G4G Blog: What is meant by Infrastructure in a Telecoms Network?

- The 3G4G Blog: Mobile Network Cell Tower Site Construction

- The 3G4G Blog: Quick tutorial on Mobile Network Sharing Options

- Connectivity Technology Blog: Different Types Of Service Providers